NZ property market takes a step backwards

Time to tango ... it’s one step back after two steps forward and a few sidesteps along the way as the property market dance continues. Sally Lindsay joins the class of 2024 to have a look.

21 April 2024

The house price correction RBNZ made sure the country had is still lingering with high interest rates restraining demand. House prices are up four per cent from the May 2023 low but remain 14 per cent below the November 2021 peak.

The latest REINZ data for March shows another step back, falling 1.2 per cent.

Most regions recorded declines, even though it’s one of the busiest months of the year.

The correction that started in November 2022, and lasted 18 months to May 2023, recorded an 18 per cent decline, with price falls recorded in 15 of the 18 months after an eye-watering 45 per cent spike.

And here we are, Kiwibank says, recovering without conviction. The annual gain in house prices sits at just 2.6 per cent. We’re back in the black, after being deep in the red, but confidence is grey.

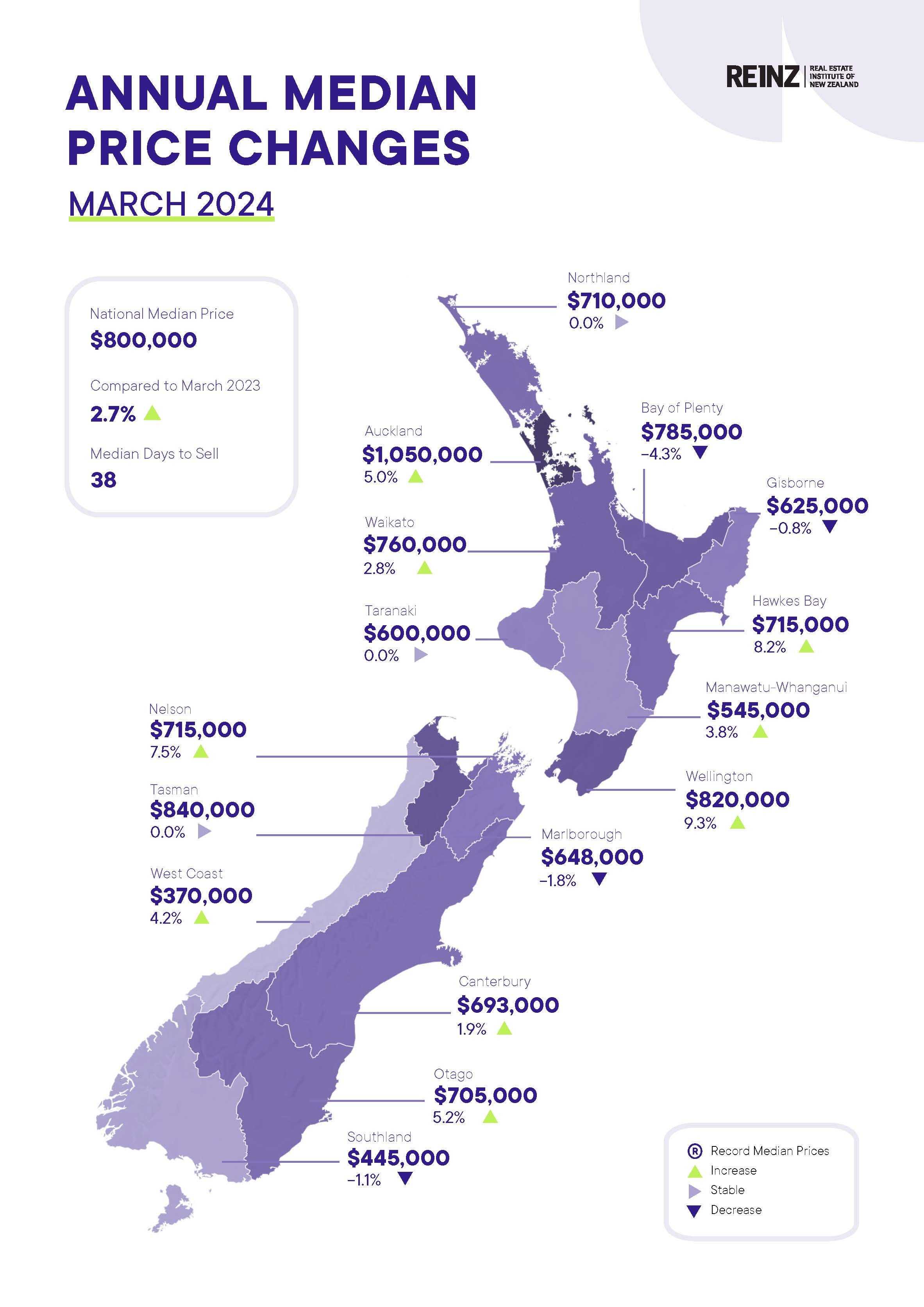

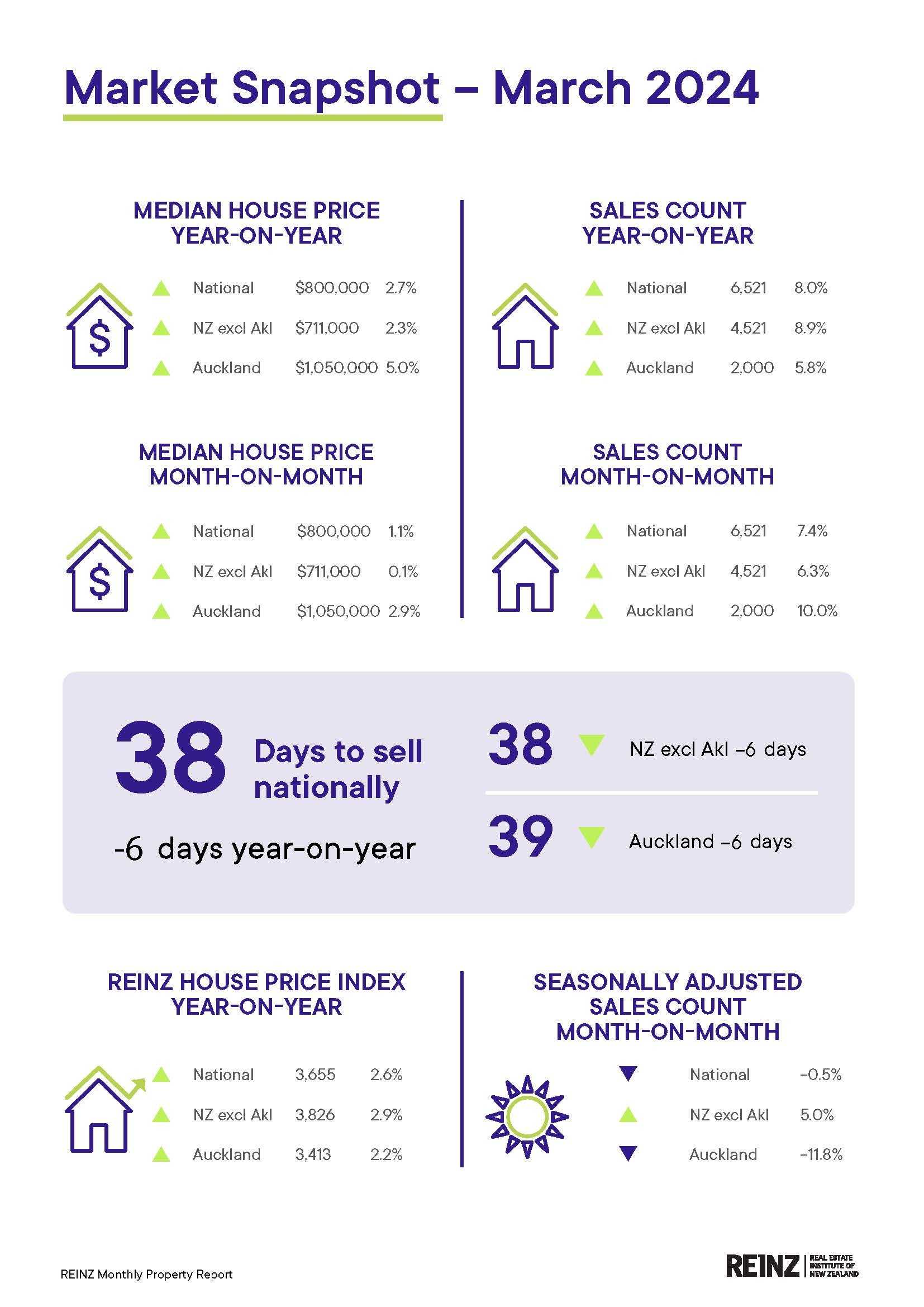

REINZ data for March show the national median sale price increased 2.7 per cent from $779,000 to $800,000 year-on-year; it also increased 1.1 per cent from February to March ($791,500 to $800,000).

Listings swing

For NZ, excluding Auckland, the median price also increased – up 2.3 per cent year-on-year from $695,000 to $711,000, and up 0.1 per cent month-on-month from $710,000 to $711,000. In Auckland it was up five per cent from 2023, to $1.05 million.

Listings on the housing market are at a level not seen since 2015. They are up 23.9 per cent to 11,455 nationally compared with March last year. Wellington had 32.4 per cent more listings; Auckland 31.4 per cent.

Only Nelson (-2.7 per cent) and the West Coast (-1.4 per cent) recorded declines in listings compared with March last year.

Nationwide inventory levels increased 13.5 per cent from 29,284 to 33,245 properties year-on-year – the highest level since 2015.

The house price index, which is designed to show the movement in house values without the volatility that can be caused by the make-up of sales, was down 1.2 per cent from February but up 2.6 per cent from March last year. Auckland’s HPI was up 2.2 per cent from March last year.

“This summer has seen a return to a more normal level of real estate market activity after a relatively slow and subdued 2023,” says Jen Baird, REINZ’s chief executive.

“Reasons for this will vary, for example some vendors may prefer not to wait any longer and are willing to ‘meet the market’ with their price expectations.”

The median days to sell measure dropped by six compared to March 2023, to 38 days on a nationwide basis. Auckland’s days to sell dropped by six to 39.

Kiwibank is still forecasting a strong five-to-seven per cent increase in house prices this calendar year. Record migration flows are boosting demand for rentals, which will boost developer confidence and entice investors back into the fray.

Interest rates

The bank’s chief economist, Jarrod Kerr, says the past few months are hard to gauge. “We’ve been through the strong seasonal period, without conviction. But activity is showing signs of improving and prices will follow. The new coalition government’s policy changes are a positive, but interest rates will play a big role. Rates may rise a little more and then they may fall, later in the year.”

However, he says the enthusiasm that followed the change in government, mainly from the investor community, has waned.

“Anecdotes from our mortgage managers and client base were positive towards the end of last year. Now we’re all waiting. It’s hard to get too excited when the rampant rise in interest rates is still feeding through. And homeowners and buyers are hanging out for rate cuts, later in the year.”

Kerr expects the market to regain momentum, but it may take a rate cut. Kiwibank is not expecting one until November. “Rate cuts are needed to encourage investors to invest, developers to develop, buyers to buy and, of course, sellers to sell.”

Price pressure

Westpac says while sales have picked up from their lows, prices remain under pressure.

The rise in sales has not been a product of stronger demand, but of increased availability, says Michael Gordon, Westpac’s senior economist.

“The number of new listings has surged in recent months, and even though there has been an accompanying lift in purchases, the number of unsold homes on the market is still climbing, reaching an eight-year high.”

He says in that light it’s not surprising some of the recent resilience in sale prices has finally given way.

Westpac estimates the REINZ house price index fell 0.2 per cent in seasonally adjusted terms in March, with annual house price growth easing from 3.2 per cent to 2.6 per cent.

“We expect the current softness in the housing market will gradually give way to a period of stronger activity, underpinned by a multi-decade high in population growth and a lift in investor sentiment,” Gordon says.

However, until the bank sees mortgage rates dropping back, the market is likely to remain moribund.